Lending rates fall, BoT new report shows

What you need to know:

- Banks have continued to lower interest rates on loans, signalling the recovery of the credit market, which experienced a contraction since mid-last year.

Dar es Salaam. Borrowers might expect the fall of costs of borrowing, following the continuous decrease in interest rates among commercial banks.

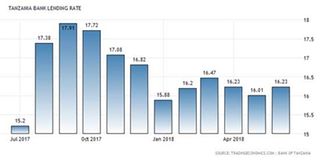

The the Bank of Tanzania’s monthly economic review for August has shown that interest rates charged on loans and offered to deposits by commercial banks declined in July 2018. Overall lending rate decreased to an average of 17.28 per cent, from 17.34 per cent in June 2018 and 17.84 per cent in the corresponding month in 2017, consistent with continued accommodative monetary policy stance.

However, that has not been reflected on the market as commercial banks’ loans are still charged at interest rates of 17 per cent, with only few have gone below the rate.

The reduction in the interest rate is expected to stimulate the credit market in Tanzania as it is now recovering from a contraction since late last year.

The BoT reports have shown that the major recovery is being experienced on personal, trade, manufacturing and agriculture.

Credit extended to the government and private sector grew by 3.9 per cent in the year ending July 2018.

This was a significant recovery from a contraction of 4.1 per cent in the year to July 2017 and 1.5 per cent in the year to June 2018.

The review has shown that the overall time deposits rate averaged at 7.83 per cent compared with 8.19 per cent and 10.56 per cent in June 2018 and July 2017, respectively.

Specifically, one-year lending rate averaged at 17.98 per cent in July 2018 compared with 19.18 per cent in July 2017, while the 12-month deposits rate decreased to an average rate of between 8.35 per cent and 11.89 per cent.

This trend was also reflected on interbank money market as it fell to 1.30 per cent during the end of July this year from 1.88 per cent recorded during the end of June this year.