Prime

Mining set for fresh boom amid increased investment

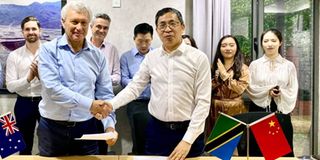

Representative from Peak Rare Earths Limited and Shenghe Resources Holding Co., Ltd after signing the agreements. PHOTO | COURTESY

What you need to know:

- Peak Rare Earth Mineral was among three Aussie firms that signed joint venture agreements with the Tanzanian government on April 17, 2023, valued at $667 million (about Sh1.54 trillion).

Dar es Salaam. Tanzania's mining sector is set for a fresh boom after recent developments, which ramped up investment in the industry.

The Australian company Peak Rare Earths Limited, which is responsible for the implementation of the Ngualla Rare Earth Project, announced recently that it has signed a binding offtake agreement with China-based Company Shenghe Resources Holding Co. Ltd.

The agreement secures a reliable market for Tanzania’s rare earth concentrate.

According to a statement issued by Peak Rare Earth, the terms of the agreement outline that Shenghe will acquire 100 percent of the rare earth concentrate and a minimum of 50 percent of intermediate and final rare earth products.

With the initial term of the agreement spans seven years, subject to Peak shareholders' approval. This commitment offers stability to the project and reinforces the long-term prospects for rare earth mining in Tanzania.

Peak Resources country manager Ismail Diwani said that by securing a steadfast market for the rare earth concentrate, this agreement imbues the Ngualla Project with a sense of stability and resilience.

“It is a pivotal milestone because in the rare mineral business you need to know where you will be supplying to. The assurance of a reliable outlet for the extracted rare earth elements not only enhances investor confidence but also nurtures an environment conducive to sustained exploration, development, and innovation,” he said.

Furthermore, the two companies also signed a non-binding Memorandum of Understanding (MoU) poised to reshape the development landscape.

According to their statement in this agreement Peak and Shenghe will collaborate around opportunities to reduce capital and operating costs, expedite construction and further optimise Ngualla.

“Potential for Shenghe to subscribe for a significant non-controlling equity interest in the Ngualla Project (via a 100 percent Peak-owned subsidiary) which would substantially lower Peak’s funding requirements,” the statement reads in part.

Commenting on the new arrangements with Shenghe, Peak Resources executive chairman Russell Scrimshaw was quoted saying that “The combination of a binding offtake agreement and a non-binding EPC and funding MoU differentiates Peak from its peers and supports a pathway to a successful project funding solution for the development of the Ngualla Rare Earths Project,” he said.

The Ngualla Project is a world-class rare earth development located near the Ngwala Village in the Songwe Region.

Ngualla is one of the largest and highest grade Neodymium and Praseodymium (NdPr) rare earth deposits in the world, a critical component of high-strength permanent magnets, which are used in the production of electric vehicles and wind turbines.

The construction of the project is expected to cost approximately $320 million and is expected commencement in May 2024.

Shenghe deputy executive chairman Huang Ping was quoted saying that his company regards the Ngualla Project as the premier undeveloped rare earth project in the world.

“We are excited to be partnering with Peak, and its Tanzanian entity Mamba Minerals, in the development of this world-class project through the provision of offtake, technical, and funding support,” he stated.

Procurement and Supply Chain professional Humphrey Simba said this agreement will have a multiplier impact on the local economy in Tanzania and also sets the stage for mutually beneficial partnerships.

“These agreements mark a significant turning point for Tanzania's mining sector, and the economy at large,” he said.

Peak Rare Earth Mineral was among three Aussie firms that signed joint venture agreements with the Tanzanian government on April 17, 2023, valued at $667 million (about Sh1.54 trillion).

The other two companies were the graphite development company Evolution Energy Minerals and the battery manufacturing Eco Graf Ltd.

That was partly one of the government’s initiatives to invite more investment in the sector with a target to improve its contribution to gross domestic product (GDP) to ten percent by 2025.

Last year through Kabanga Nickel Ltd (KNL) which is implementing the extraction of the world’s largest development-ready nickel sulfide deposit in Tanzania, a $100 million investment was secured for the project from the global resource firm BHP.