Prime

Opportunities, challenges as gold soars to all-time high

What you need to know:

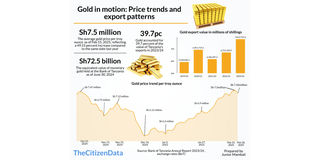

- The price of gold surged to a record-breaking Sh7.5 million per troy ounce on February 15, 2025

Dar es Salaam. The price of gold surged to a record-breaking Sh7.5 million per troy ounce on February 15, 2025 marking the highest level ever recorded, according to the Bank of Tanzania’s exchange rates.

The rise by Sh1.3 million from an average of Sh6.2 million on January 2, 2025 reflects growing investor demand amid ongoing global economic uncertainty, including inflationary pressures and currency fluctuations.

Despite reaching new heights, the gold market remains volatile. After peaking at an average of Sh7.46 million on October 31, 2024, the price has slightly declined, settling at Sh7.42 million as of Tuesday, February 18, 2025.

Nevertheless, compared to the same period last year, when gold was priced at Sh5.02 million, the current value represents a 49 percent increase, underscoring the growing appeal of gold as a safe haven asset.

Bank of Tanzania (BoT) governor Emmanuel Tutuba said the increase in gold prices is a reflection of broader economic dynamics, particularly the impact of inflation and currency devaluation, which are prompting more individuals to invest in gold.

“Global uncertainties have resulted in increased demand for gold as a stable asset. Inflationary pressures and currency fluctuations are key drivers pushing people toward gold as a secure investment,” he said.

The latest data from the London global market reveals that, on February 15, 2025, the price of gold rose to $2,908 per ounce, up from $2,812 per ounce at the end of January, indicating a notable increase in just one month.

Mr Tutuba attributed this rise to shifts in supply and demand dynamics within the precious metals sector, including the availability of gold from mining operations.

“Global challenges such as political instability, economic crises, and ongoing conflicts, including wars, have spurred uncertainty in financial markets, pushing investors to seek safe-haven assets like gold,” he added.

Financial analyst Oscar Mkude pointed to specific global events, particularly in the US, which may be influencing market trends.

“The downturn in the stock market, coupled with drastic measures taken by President Donald Trump, has led many investors to turn to gold for stability,” he said.

Mr Mkude also highlighted the ongoing war in the Democratic Republic of Congo and South Africa’s decision not to send gold to the US as factors contributing to the market shift.

Small-scale gold miners in Tanzania are closely monitoring the price changes and feeling the impact of the market surge.

MS Euphrosina Mtundu, a miner in Kahama, noted that she is earning more from her gold sales, particularly for high-purity gold.

“When I sell gold with 96 to 99 percent purity, I make a significant profit, especially now with the prices being higher,” she said.

Another miner at the same site, Mr Zacharia Soko, explained that the price for gold with 98 percent purity has risen notably.

“One gram now costs Sh218,000 compared to Sh185,000 in January,” he said.

“This increase is beneficial for miners like myself, especially with the government's efforts to establish mineral markets that ensure stable pricing and allow for the collection of royalties and taxes.”

As the price of gold continues to fluctuate amidst global uncertainties, all eyes remain on whether the precious metal will stabilise or continue to rise in the coming weeks.