Prime

Tanzania bucks regional trend as investment inflows surge

What you need to know:

- Tanzania recorded a significant increase in foreign direct investment in 2023, positioning itself as a standout performer in East Africa

Dar es Salaam. Tanzania recorded a significant increase in foreign direct investment (FDI) in 2023, positioning itself as a standout performer in East Africa amid global economic challenges, a new report reveals.

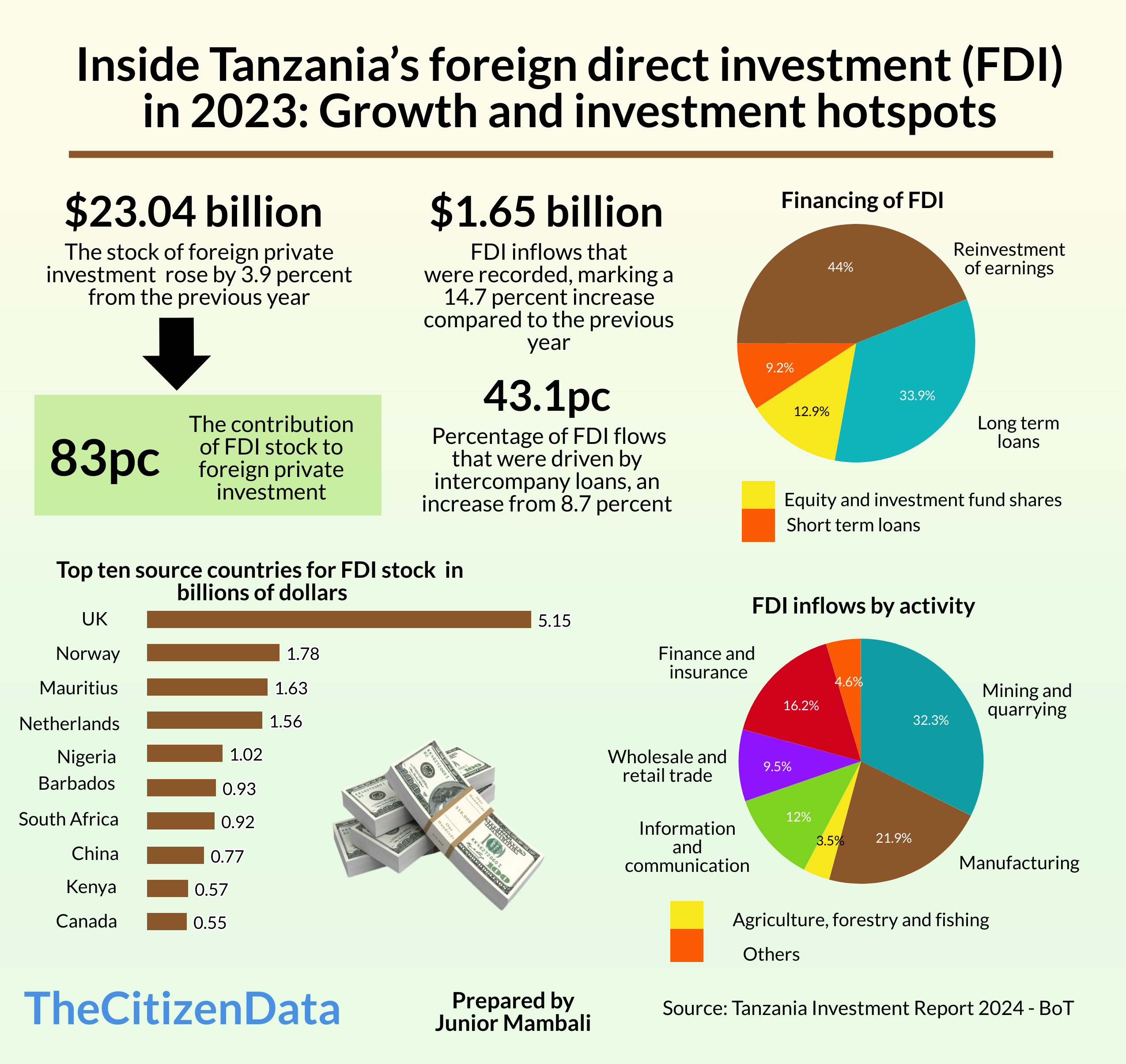

The Tanzania Investment Report 2024 – jointly published by the Bank of Tanzania (BoT), the Tanzania Investment Centre (TIC) and the National Bureau of Statistics (NBS) – indicates that FDI inflows surged by 14.7 percent to $1.65 billion in 2023, up from $1.44 billion the previous year.

The report, which was published last Friday, shows that the increase was largely driven by a sharp rise in intercompany loans, which grew to 43.1 percent of total FDI flows, up from 8.7 percent in 2022.

In contrast, the World Investment Report (WIR) 2024 shows that other East African nations either recorded a decline or stagnation in FDI inflows. Kenya’s FDI fell to $1.5 billion from $1.6 billion, while Uganda, despite its oil wealth, saw a drop from $3 billion to $2.9 billion. South Sudan experienced a complete halt in inflows, registering $0 compared to $0.1 billion in 2022, while the Democratic Republic of Congo’s FDI declined from $1.8 billion to $1.6 billion. Rwanda’s FDI stagnated at $0.5 billion.

The report attributes Tanzania’s FDI growth to a range of government initiatives aimed at improving the business environment. These include regulatory reforms, infrastructure development and positive ratings by international credit agencies. Since 2020, Tanzania’s FDI has shown a steady increase, rising from $944 million in 2020 to $1.2 billion in 2021, $1.4 billion in 2022 and $1.65 billion in 2023.

Attractive sectors

The mining, manufacturing, finance, insurance and information and communication sectors accounted for 82.4 percent of Tanzania’s total FDI inflows in 2023. Notably, investments in the information and communication sector more than doubled to $198 million, driven by rising demand for internet services and mobile money transfers. Manufacturing FDI also surged to $361 million, supported by the government’s industrialisation drive and recovery from global shocks.

However, mining and quarrying, the leading contributor to FDI, recorded a decline to $532.5 million from $847.1 million in 2022, mainly due to loan repayments and losses incurred by companies still in the exploration phase.

The report attribute Tanzania’s success in attracting FDI to improvements in infrastructure, including the development of roads, the standard gauge railway, air transportation and the completion of the Julius Nyerere Hydro-Electrical Power Project. Additionally, the government’s agreement with DP World to enhance operations at the Dar es Salaam Port is expected to further boost investor confidence.

The report seems to concur with the KPMG’s Doing Deals in Sub-Saharan Africa Report (October 2023), which ranked Tanzania as the third most preferred investment destination in sub-Saharan Africa, behind South Africa and Nigeria. The country’s stable macroeconomic environment, competitive tax regime and ongoing digitalization efforts further reinforce its appeal to investors.

Despite Tanzania’s positive FDI trajectory, experts warn that sustaining this momentum will require maintaining a stable tax regime, political stability and favourable exchange rates.

Speaking to The Citizen, Prof Dickson Pastory from the College of Business Education emphasized the need for policies that encourage FDI, including raising awareness in international markets and offering export processing zones.

“To maintain healthy and sustained FDI growth, Tanzania must create a balanced, stable and attractive environment for investors while continuing to diversify its sectors. This will help the country avoid over-reliance on one industry and promote long-term economic resilience,” he said.

Financial analyst Oscar Mkude stressed the importance of sector diversification to maximize the economic benefits of FDI.

“While FDI is crucial, its concentration in a few industries does not reflect the full picture of an economy. To achieve greater inclusivity, Tanzania must broaden its investment across various sectors,” he said.

Mr Mkude also noted that while Tanzania has shown steady FDI growth since 2015, Uganda led in FDI inflows in 2018, driven by investments in the East African Crude Oil Pipeline (EACOP). He added that the upcoming Liquefied Natural Gas (LNG) project in Tanzania could significantly alter the country’s FDI trajectory in the coming years.

Meanwhile, Rashid Aziz, an assistant lecturer in banking and finance at Ardhi University, emphasized the role of FDI in economic expansion.

“When FDI inflows increase, it typically leads to economic reforms. Creating a favorable environment for manufacturing, including offering capital incentives, is key to attracting more investments,” he said.

Aziz also highlighted the importance of transparent regulations and investment-friendly policies to ensure sustained growth.

Additional reporting by Rosemary Mirindo