Prime

Why shilling has lost ground against regional counterparts

What you need to know:

- The Tanzanian shilling has been losing ground against its Ugandan and Kenyan counterparts in recent months despite exports to the two neighbouring countries increasing

Dar es Salaam. The Tanzanian shilling has been losing ground against its Ugandan and Kenyan counterparts in recent months despite exports to the two neighbouring countries increasing, available data shows.

However, the shilling has been gaining against the Rwandan and Burundian francs.

According to analysts, this could be explained by the fact that despite being neighbours and partners under the East African Community (EAC) banner, most of Tanzania’s exports to Uganda and Kenya are transacted in the US dollar.

“This creates huge demand for the dollar compared to the Tanzanian shilling. It means that although we export a lot, exporters demand to be paid in dollars thereby creating high demand for the vehicle currency at the expense of the local one. This, in essence, benefits the Ugandan and Kenyan currencies,” financial analyst Bernard Mumwi told The Citizen.

Bank of Tanzania (BoT) governor Emmanuel Tutuba had similar views.

“Basically, when people use the Tanzanian shilling to buy goods, it helps strengthen the local currency. However, when large numbers of traders from Uganda and Kenya or other countries come to buy goods and transactions are conducted in dollars, the local currency will obviously weaken,” he said.

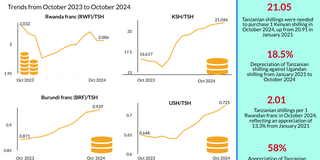

An analysis of the trend shows that one needed Tsh20.906 on average to get Ksh1 in January 2021, but the same fetched an average of about Ksh21.046 in October 2024, translating into a decline of about 0.7 percent.

Tanzanian shilling dropped by 18 percent against the Ugandan shilling during the same period.

While one needed Tsh0.612 to get Ush1 on average in January 2021, the same fetched an average of Tsh0.725 in October 2024.

During the same period, the Tanzanian currency has, however, appreciated by 58 percent and 13.3 percent against the Burundian and Rwandan francs, respectively.

While one needed an average of Tsh2.198 to get one Burundian franc in January 2021, the same was worth an average of only Tsh0.928 in October 2024.

Similarly, while one needed an average of Tsh2.313 to get one Rwandan Franc in January 2021, the same was worth an average of Tsh2.006 in October 2024.

According to Mr Mumwi, at a time when Tanzania was grappling with a shortage of US dollars in the market, those who exported to Uganda and Kenya demanded that they be paid in the vehicle currency.

“That created high demand for the dollar and that is why our currency lost ground against the Ugandan and Kenyan currencies. That is precisely what you see in the numbers,” he said.

The double-digit gain in value of the Uganda shilling against its Tanzanian counterpart could probably explain the growing trade between the two countries, with data showing that Tanzania is now the leading source of Uganda’s imports in Africa.

Recent data, sourced from the Bank of Uganda, shows that almost half of Uganda's imports from within Africa are sourced from Tanzania, which is the second largest source of Uganda's imports after China.

Tanzania has overtaken Kenya as Uganda’s largest source of imports, denoting a shift in trade, especially within Africa, according to a recent report in Uganda’s Daily Monitor.

Kenya has traditionally been Uganda’s largest trading partner, but data indicates that East Africa’s largest economy is now second after Tanzania in terms of Uganda’s largest source of imports from within Africa.

Data from Bank of Uganda indicates that during the year ended June 2024, Uganda imported goods worth $4.17 billion from the Common Market for Eastern and Southern Africa (Comesa) and the rest of Africa combined, of which almost half was from Tanzania.

Uganda, according to data from the Uganda Revenue Authority, imports mostly gold, rolled iron or non-alloy steel, groundnuts and carboys, bottles and flasks from Tanzania.

Gold comprises more than half of Uganda’s imports from Tanzania. URA data indicates that Uganda imported gold worth Ush1.08 trillion in 2023.

Data indicates that 42.56 percent of Uganda’s imports from within Africa were in the year ended June 2024, sourced from Tanzania, compared to 19.55 percent from Kenya and 6.43 percent from South Africa.

Ivory Coast and Burkina Faso rounded off the list of the top five largest sources of Uganda’s imports in Africa, contributing a percentage value of 5.27 percent and 5 percent, respectively.

The Bank of Uganda further indicates that during the year to June 2024, Uganda spent $1.77 billion on imports from Tanzania, which was more than triple the $450.46 million recorded in the year to June 2023.

Kenya, which for years had been Uganda’s leading source of imports in Africa, is now in second position, with a contribution worth $816.71 million, which was a slight reduction from $860.71 million recorded in the year to June 2023.

Kenya is followed by South Africa with an import bill of $268.8 million, an increase from $182.43 million, while imports from Ivory Coast and Burkina Faso registered tremendous increases, rising from $14.88 million to $220.33 million and $50.17 million and $208.88 million, respectively.

Uganda largely imports cement, rolled iron or non-alloy steel, petroleum oils, scrap and articles of plastics from Kenya, while from South Africa the country imports mostly pearls, precious stones, metals, coins, vehicles other than railway, tramways, iron and steel, and machinery, nuclear reactors and boilers.

Additional reporting by Rosemary Mirondo