Equity Bank starts remittance services

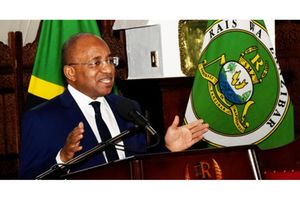

Equity Bank (T) managing director Robert Kiboti (centre) is flanked by the lender’s executives at the launch of the new remittance windows known as “Equity ni Moja” that allows Equity customers in all subsidiaries of Tanzania, Kenya, Rwanda, South Sudan, and DRC to transact as at domicile country, and Sadc-SIRESS services that allows customers to transact in all Sadc countries at the rate of only $10 per transaction. PHOTO | COUTERSY

What you need to know:

- The platforms are: Equity Bank Interbank transfers and Sadc Integrated Regional Electronic Settlement System (Siress) Services.

Dar es Salaam. Equity Bank Tanzania yesterday introduced in the market two new remittance services in an effort to boost inter-country and regional remittance transactions.

The platforms are: Equity Bank Interbank transfers and Sadc Integrated Regional Electronic Settlement System (Siress) Services.

The former allows real-time transactions for Equity Bank customers in any Equity Bank group branches while the latter opens up remittance transactions within the 16 Southern African Development Community (Sadc) member states.

Equity Bank managing director Robert Kiboti said in Dar es Salaam yesterday that the services provide a reliable financial link between Equity Bank customers in Tanzania with the rest of the lender’s network through its One Equity Inter-Country services which allows seamless real-time transactions at a minimal cost.

“It simply means that Equity Bank customers will be able to make deposits, receive deposits, and make withdrawals at any Equity Bank branch online in Kenya, Uganda, Rwanda, South Sudan, and the DRC as a domicile country,” he said.

He said it also meant that Equity customers can now transfer to an Equity customer in any country of operation. “The primary goal of the product is to provide solutions for Equity customers and non-customers (deposit only) across the Group to access their accounts and transact from any of the Equity Bank group subsidiaries, in any of the local currencies.

“We believe this will be an important solution to facilitate cross-border payments between Tanzania, Kenya, DR Congo, Rwanda, and the rest of Equity network. I call upon all cross-border traders, including SMEs and transporters to capitalize on these new services,” said Mr Kiboti.

The Siress, he said, was an automated interbank settlement system by the Sadc participating member countries of Angola, Botswana, Comoros, Democratic Republic of Congo, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Tanzania, Zambia, and Zimbabwe. “Through these services, customers and non-customers will perform low-cost and secured cross-border payments within the region and make payments between countries,” he said.