Gulf States intensify scramble for control of Africa investments

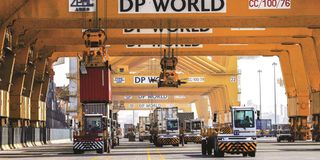

Terminal tractors line up to load containers into a cargo ship at DP World's fully automated Terminal 2 at Jebel Ali Port in Dubai, United Arab Emirates on December 27, 2018. PHOTO | POOL

The African investment landscape faces a major shift as Gulf Co-operation Council (GCC) member States — especially Saudi Arabia, the United Arab Emirates (UAE) and Qatar — increase their footprint on the continent, largely under the control of the Chinese investors.

A new report by the Economist Intelligence Unit (EIU), the research and analysis division of The Economist Group, shows that GCC companies and institutions are targeting a larger share of Africa’s resource industries of oil and gas, mining and agriculture, while consolidating their strong position in transport infrastructure and logistics services, and expanding into renewable energy, digital infrastructure, manufacturing ventures and financial services.

The report titled The Gulf Co-operation Council’s Expanding African Footprint: Strengthening Ties and Increased Investment shows that Saudi Arabia, UAE and Qatar are already major investors and traders in African ventures and appear intent on expanding their footprint across the continent.

“The GCC and African States have strong incentives to build closer commercial and political ties, which from an African perspective include the vast amounts of finance available in the GCC and the willingness of GCC companies and investors to place their bets on Africa,” the report says.

The GCC brings together six Arab countries- Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

China has maintained a substantial presence on the continent for over two decades, but the growing interest of Western powers in Africa could impact China's Belt and Road investment (BRI) plan that was launched in 2013.

The US and the European Union have announced intentions to enhance investments on the continent.

In 2022, the US joined other G7 nations in a $600 billion Partnership for Global Infrastructure and Investment (PGII) and Brussels announced a new Africa policy.

According to the EIU, the GCC is reported to have invested over $100 billion in Africa over the past decade, or about 30 percent of its total outward Foreign Direct Investment (FDI).

In 2022, UAE pumped $50 billion worth of FDI in Africa to overtake China and the USA as the continent’s largest investor, according to a survey report by consultant firm Ernst & Young.

The investment, which is seven times more than the amount committed by the US investors, was mostly channelled to Egypt and South Africa, which made up 95 percent of the continent’s total capital inflows from Abu Dhabi.

The report shows that China and US’s share of FDI into Africa is shrinking, with UAE significantly boosting its presence on the continent.

“Cumulative FDI between 2016 and 2022 sees China ranked fourth by projects, while it comes second by capital investment, behind the UAE,” according to the Africa’s Attractiveness report titled ‘A Pivotal to Growth.’

China is a major infrastructure financier in sub-Saharan Africa, with a total investment of $155 billion over the past two decades.

UAE has taken a lead in developing closer ties with the African transport sector and has a controlling stake in numerous African ports.

Together, Dubai-based DP World and Abu Dhabi-based AD Ports Group have secured concessions, often on a multidecade framework, to develop and operate key seaports and inland ports in Algeria, Egypt, Sudan, Eritrea, Somaliland, Somalia, Tanzania, Mozambique, South Africa, Angola, the Democratic Republic of Congo, Congo-Brazzaville, Rwanda, Nigeria, Guinea and Senegal.

In October 2023, DP World and the Tanzanian government signed a deal for the Emirati logistics company to manage two-thirds of Dar es Salaam port for the next 30 years.

The following month, AD Ports signed an agreement with the Egyptian government to develop a multipurpose terminal at Safaga seaport, and the Abu Dhabi company is leading a mega project in Sudan to build and operate the Abu Amama port and economic zone.

Bilateral trade in goods between the two regions (Africa and GCC) grew by a compound annual growth rate of eight percent in the 10 years to 2022, which included a notable acceleration in growth in the value of bilateral trade in 2021 and a record high of $154billion in 2022.

“This record level of bilateral trade with Africa places the GCC far ahead of the US ($74 billion) and India ($99 billion) in 2022 and has closed the gap with the other major trading partners of China ($289 billion) and western Europe ($244 billion),” says EIU.

“Oil and gas sales remain the bedrock of GCC exports to Africa, and mining sector output is a key component of GCC imports from Africa, but trade beyond these traditional sectors is flourishing and will continue to grow on the back of the GCC’s cumulative and increasingly diversified investment on the continent.”

According to the EIU, investing in port infrastructure, operating key transport nodes and partnering with or investing in African transport and logistics companies will remain a key strategy for GCC states.

In particular, the UAE has taken a lead in developing closer ties with the African transport sector and has a controlling stake in numerous African ports.

UAE forays into the African port sector are supplemented by the outreach of its airline companies to the continent.

“An overarching aim is to leverage rapidly growing intra- and extra-African trade and secure the UAE’s tight grip on Africa’s key import-export nodes— specifically the logistics routes connecting Africa with the Middle East, Asia and Europe,” the EIU report says.